LexART 2 - Finding a Standard

Artists today can use LexART to tokenize unique art by minting one ERC20 token with a reference to an Arweave hash. Once minted, artists can receive automatic royalties payout together with future collectors. In other words, LexART has the ability to pay all owners of a token for owning it. Considering how difficult it is to track royalties payout in meatspace, LexART is an efficient alternative.

LexART definitely has its limits. For one, it does not conform to the NFT market standard of ERC721, thus incompatible with the current ecosystem. Another limit is that it is not a generative / programmatic NFT like CryptoKitties or CryptoPunks, it is just a non-fungible token in the form of an ERC20 with supply capped at 1. Yet another limit is the reliance on Arweave to deliver a perma web. Despite its limitations, I spot a positive in that the NFT market is growing with non-generative art, or art conceived by humans. Perhaps LexART could similarly serve as an efficient alternative in the cryptoart space as it grows.

Shout out to NonFungible.com for making the Non-Fungible Art report 2018-2019.

Before we go on, I need to organize existing platforms into different categories for the purposes of understanding the ecosystem:

Since the use of LexART is most comparable to those in the open and curation marketplace categories, we’ll take a look at platforms in these 2 categories and compare how royalties are handled.

In general, open marketplace platforms encourage artists to submit new work. The bar for submission is low but, as a result, discovery of art can get quite noisey. Collectors also bear the risk of purchasing counterfeits, as seen here. Curation marketplace platforms operate much like traditional art galleries in that they work with artists when there is a good match, i.e., aligned vision, friendly relationships, similar artistic experience, etc. The bar for submission is higher and more subjective, discovery is a better experience, and collectors should expect genuine art.

Now that the basic background is laid, we’ll get into royalties. I’m particularly interested in royalties structure because it’s a concrete way of sharing appreciation for art and support for artists. Having an appropriate royalties structure also aligns incentives between artists and collectors, allowing the cryptoart community to grow the pie so to speak.

How platforms structure royalties, however, has been experimental. Over a short span of time, we’ve seen royalties structures evolve. Throughout the research phase of this post, some platforms actually updated their royalties structure on their website, Medium, etc. Platforms should continue to experiment with different royalties structures, and perhaps even try out different structures for different forms of art.

Without further ado, leggo. To compare royalties structures, here’s a Google Sheet (“Curation Marketplace” Tab) with the numbers plugged in. You’ll find on the left a table for calculating distribution in %, in the middle a table for calculating distribution in $, and on the right a table of sources.

Support me on Cent 🙏

The top chart shows the monetary breakdown of a given art sold in primary sale, with blue repping platform share and red for artist. The consensus for primary sale is around 85% artist and 15% platform. The bottom chart shows the same in secondary sale, with blue repping platform share, red for artist, and yellow for collector (or buyer). The consensus for secondary sale is around 88% collector, 10% artist and 2% platform.

As for the mouse drawing I added re LexART, artists today can mint with it and get 100% on primary sales. For secondary sales, a community of collectors will own the art together. Great, but the fact is LexART doesn’t yet have a front end or community, and its code is experimental at best. That said, a communal royalties structure for secondary sale of cryptoart may be fun to try out 🤘

It seems like platforms are asynchronously working towards a standard for both primary and secondary sales. Or perhaps the cryptoart community is actually working together in some ways. Conlan did introduce http://blackbox.art/royalties/ to me.

“In the spirit of partnership and building a better world for art, artists and art lovers, we call on CryptoArt marketplaces and platforms to implement this guarantee in their smart contracts as soon as is reasonably practicable.”

- Sparrow

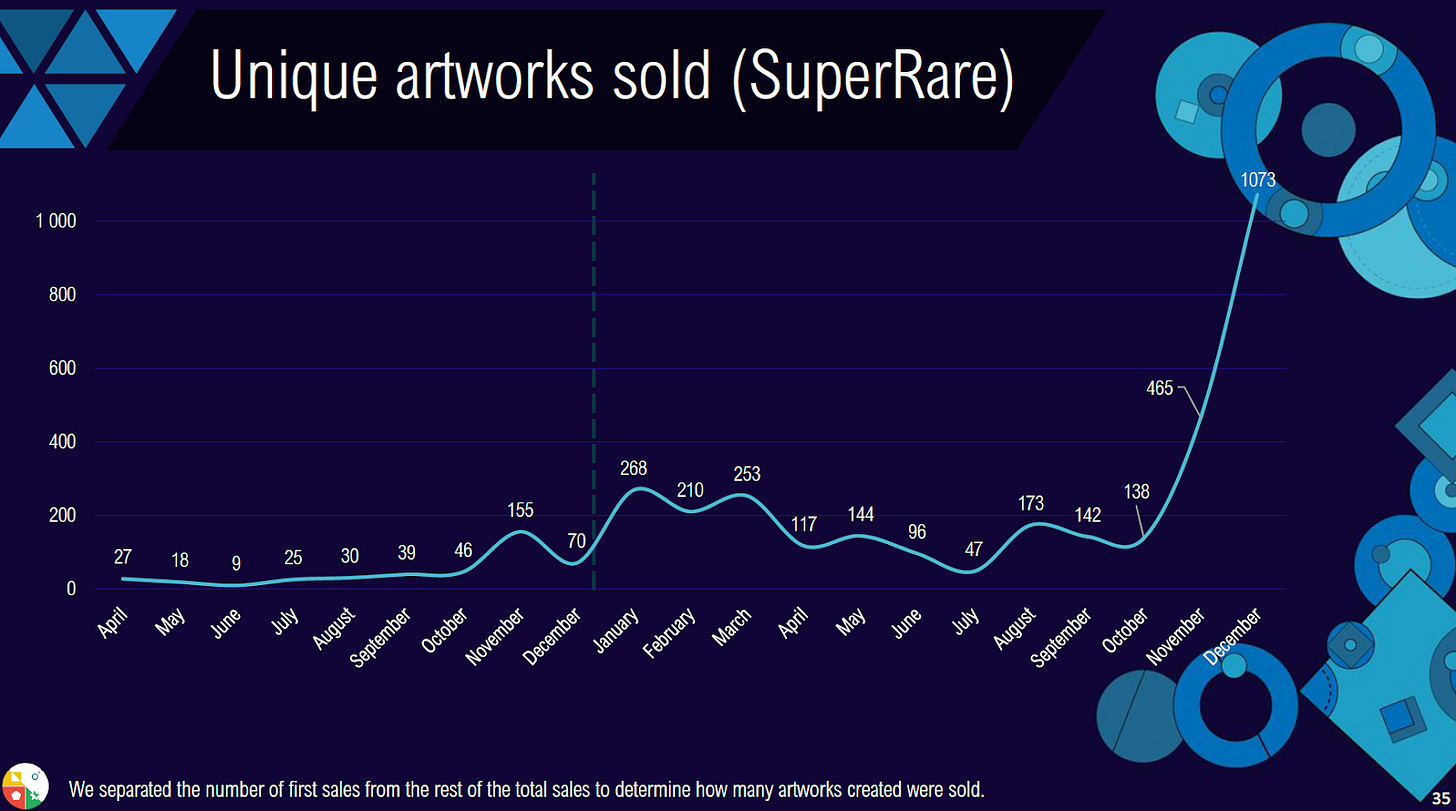

Source: Non-Fungible Art report 2018-2019

Whatever it is, I’d imagine platforms have done a great job in securing royalties for artists, as I’ve yet to come across anyone calling to take down the royalties layer. With the number of unique artworks sold trending upwards, it’s comforting to know that artists are also getting paid automatically. Thanks platforms for taking the lead!

Reflect

I think I’m pretty deep in this 🕳️ but there is just so much moreeeeee.... For the next post, I’ll write about upgrades I’ve made to LexART. Thanks for reading!